Your Genesys Blog Subscription has been confirmed!

Please add genesys@email.genesys.com to your safe sender list to ensure you receive the weekly blog notifications.

Subscribe to our free newsletter and get blog updates in your inbox

Don't Show This Again.

In the banking industry, product differentiation is exceptionally difficult. And customer experience is where financial services companies set themselves far apart from their competition. But offering experiences that consumers deem unique and engaging is an ongoing challenge.

Because of their experiences with leading retailers, social platforms and streaming services, consumers expect those seamless, personalised interactions across their end-to-end journeys in every industry. As these businesses raise the bar on improving the customer experience, expectations rise as well.

Research by FT Longitude exposes some of the challenges: 61% of banking executives say continuous innovation is raising customer expectations, and 45% admit their organisations struggle to keep up. That’s not all. More than half say that although they aim to provide a personalised experience, it appears to customers as generic.

Banks that don’t prioritise customer experience are at risk of commoditisation and losing relevance in their customers’ financial lives. For both traditional branch organisations and “digibanks,” loyal and mutually beneficial customer relationships are critical for driving business outcomes.

A newly published survey from Genesys reveals an empathy gap in the banking customer experience. Customers want to feel heard and understood, served with experiences that are convenient and personalised. This is how they view empathy — and a lack thereof. Banks that successfully close this gap will delight customers and outperform the competition.

The empathy gap is most apparent in three areas of the banking customer journey: complex and unwelcoming onboarding processes; generic and disjointed day-to-day interactions; and impersonal financial planning experiences. Improving each of those areas provides banks with an opportunity to create customer journeys that are effortless and make customers feel valued. Here’s how.

Just a quarter of survey respondents found their recent account or product application process was clear and transparent. A slightly higher percentage (27%) strongly agreed that the account setup process was straightforward.

As a result, only 25% felt welcomed as a new customer — hardly setting the relationship off to a great start.

Banks should stop making it so hard to become a customer. Instead, they can continually optimise onboarding processes by simplifying interactions and responding to customer preferences.

Banks have no shortage of data. But it’s essential to put the puzzle pieces together for a complete view of the customer across all interaction channels and events.

Journey analytics tools deliver real-time visibility into customer interactions, allowing banks to understand customer preferences and respond immediately. They’ll also understand which process improvements will have the greatest customer impact.

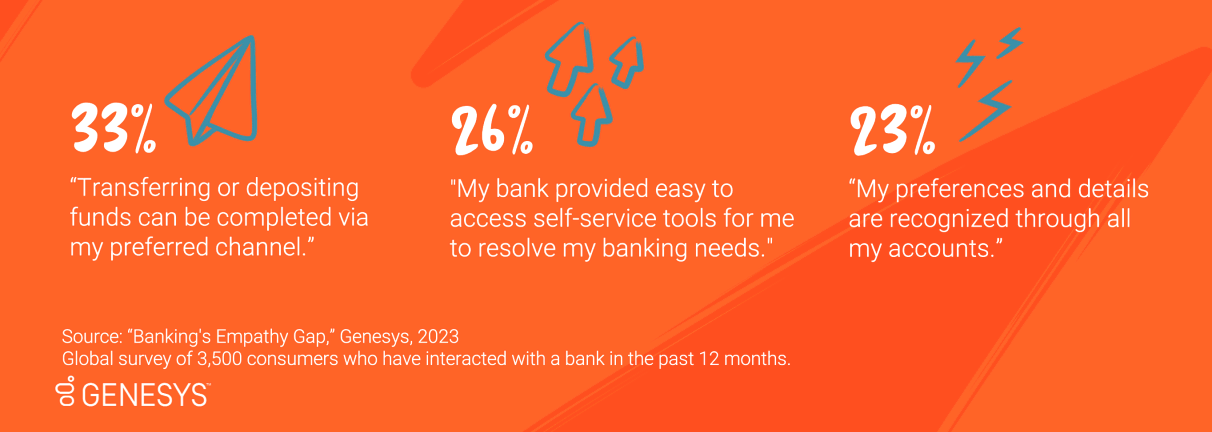

Consumers worldwide say the type of personalisation they value most is receiving the services they need in their channel of choice. Yet, many banks struggle to provide this.

Only one-third of survey respondents strongly agreed that they were able to complete a transaction in their preferred channel. And just 23% said that their bank recognised their preferences across accounts. The result is a customer journey that feels fragmented and impersonal, with dead ends, repetition and being forced to start over. This serves as a good reminder that customer experiences happen — whether you designed them that way or not.

The state of digital transformation in banking is one reason for the disjointed journeys. The FT Longitude research found that just 4% of banks globally have connected their technology and data for delivering an omnichannel experience. This means they’re neither able to transfer customer context across channels, nor personalise customers’ interactions in real time.

Banks need to bridge data, departmental and functional silos to enable omnichannel engagement. They also need to ensure that robust insights are available to frontline employees and fed into self-service tools to provide the most relevant customer interactions.

Additionally, shifting to a cloud-based customer experience platform will allow them to integrate systems — from core banks systems to CRM solutions and marketing tools. And they can connect channels and build a holistic view of customers. This will enable meaningful personalisation across the end-to-end journey that fosters engagement and loyalty.

While many banks aim to be trusted advisors, from the customer’s perspective it’s a transactional relationship. Less than one-quarter of consumers strongly agreed that their bank understands their financial needs and provides relevant financial coaching. And just 28% said their financial advisor helped them understand the need to adjust their financial plan.

To deliver personalised experiences at scale, banks need to accelerate digital transformation across the end-to-end journey in a way that also empowers bankers to excel with their human touchpoints. Journey management tools used with predictive engagement, virtual agents and predictive routing (i.e., connecting customers with the right employee) — allow banks to create convenient and personalised interactions in the customer’s preferred channel. And using a common CX platform across branches and the contact centre allows branch bankers to deliver customer services during less busy times for the branch. This helps branch employees better meet their bonus goals.

Technology is also allowing bankers to provide more meaningful interactions. These include tools for setting financial goals, understanding the products available to reach those goals and educating customers on how to self-serve in the bank’s online trading app. Banks also can use predictive analytics to inform advisors of next-best actions for individual customers looking to build their portfolios.

Organisations today are competing more than ever on customer experience, raising the “expectations bar” for all industries – including banks. That means innovations in financial products and services aren’t enough to attract and retain customers.

Banks must close the empathy gap created by complex onboarding processes, disjointed day-to-day banking interactions and impersonal financial planning experiences. It’s time for banks to shift to a customer journey approach that enables them to close that gap.

By implementing connected technology, measurement and management, banks can orchestrate and optimise customers’ experiences in real time. This approach requires cloud-based technologies, automation and artificial intelligence to connect and coordinate channels, data, employees, interactions, knowledge and systems.

At a time when 77% of consumers will leave a brand after five or fewer poor interactions, offering empathetic end-to-end customers experiences is a business builder to bank on.

There’s frustration at every stage of the consumer banking experience. Download our to learn how financial services providers can empower consumers with seamless journeys.

Subscribe to our free newsletter and get the Genesys blog updates in your inbox.

Related capabilities: