Your Genesys Blog Subscription has been confirmed!

Please add genesys@email.genesys.com to your safe sender list to ensure you receive the weekly blog notifications.

Subscribe to our free newsletter and get blog updates in your inbox

Don't Show This Again.

Banking products often are strikingly similar from one bank to another. While one bank might offer a slightly different rate on its interest savings account than another, little else differs. And the less the differentiation, the lower the customer loyalty toward that institution. That means there’s a higher risk customers will go elsewhere for a slightly better deal.

To make an impact in an industry where many products and services are commoditised, the biggest opportunity to increase loyalty is by winning on customer experience (CX). This includes having highly trained, motivated and licensed customer-facing employees who deliver relevant, empathetic experiences.

As the use of digital capabilities and channels increase, banks can further differentiate by providing more personalisation throughout the customer journey. This can even include the products and services they provide.

Prescriptive personalisation within and across channels, interactions and products is the future.

Seventy-two percent of executives from banks that are considered CX leaders, surveyed for “The Challenge of Customer-Centric Banking,” a report by FT Longitude and supported by Genesys, say more personalised products and services lead to greater customer loyalty.

But even banks known for excellent service find it challenging to create experiences that are genuinely differentiating in the eyes of customers. More than half of executives at the most advanced banks, the “CX Leaders,” say that, although they aim to provide a personalised experience, it often appears generic to customers.

That’s one reason those banking executives say investing in new technology to drive customer understanding and personalisation is the most important transformation to drive their businesses in the next two to three years.

That new technology includes artificial intelligence (AI): Banking executives consider AI/machine learning a top three technology for understanding customers’ personal finances and goals. AI enables them to bring real value to personalisation through individualised customer treatments and marketing engagement.

Many consumers — and business leaders — think of tailored communications as personalisation. Adding a customer’s name to an otherwise generic email, using a form-fill in a chatbot, or using authentication in the contact centre so the agent can address a caller by name are examples of the most basic types of personalisation. But they’re only “friendly” — not actually personal.

Presenting customers with more personalised marketing offers based on their past behaviour is another obvious and frequent approach. But there’s a greater opportunity.

In the broader sense, truly unique personalisation in banking happens when customer-facing employees and digital technologies provide the right solutions for each customer to help them immediately. And with more advanced applications of personalisation, banks can anticipate customer needs.

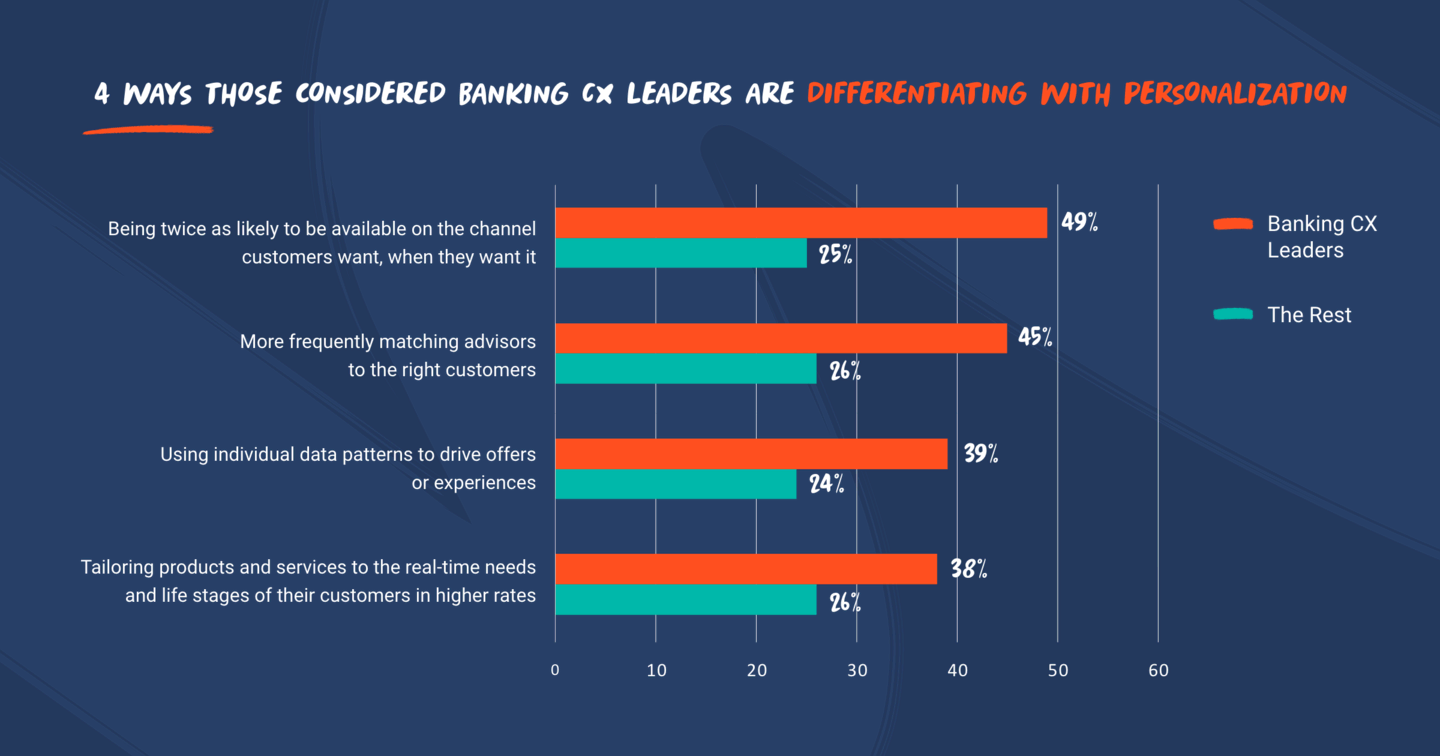

Those considered banking “CX Leaders” in the FT Longitude study are outperforming their peers by:

When a bank designs experiences unique to each of its customers, that leads to greater loyalty and competitive advantage. There are four areas where banks can adjust their CX strategies to drive increasingly personalised experiences.

Where personalisation truly begins with security is using tools like facial recognition to log into a brokerage account or voice authentication as a password. These technologies are available but not widespread.

In the future, watch for the availability of using a hand/palm print as authentication for ATM interactions.

The technology is available to achieve more individualised outcomes. It can identify if a customer looks or acts like another customer and, therefore; might respond similarly.

Linking a customer experience platform with a CRM system or marketing technology can help to create this real-time, holistic customer view. And customer sentiment tracking tools can help assess when a client is most likely to respond positively to an offer or advisor outreach.

For example, a customer might purchase an investment product using the bank’s app, email their advisor about the purchase and then schedule a video chat to discuss it. The customer initially leads the conversation. Then, that same customer’s advisor schedules a video chat in the app about a new investment product that might be of interest, and the customer can make the purchase while in the app with the advisor.

Banking executives surveyed by FT Longitude consider a super-app strategy a top three technology for understanding customers’ personal finances and goals.

Personalisation will happen when a customer can specify, “I want a financial advisor who has this specific expertise…” Customers can set their preferences and choose their service experience.

Twenty years ago, banks won on scale with a one-size-fits-all approach. In the past 10 years, banks have been gaining an advantage using segment-based personalisation. It’s been beneficial, but it’s no longer enough.

Going forward, personalisation in banking needs to be predictive and proactive. And it has to be truly unique to each customer by providing choice and selection in everything from products and services to advisors, channels and security measures. To meet their own financial goals in the future, banks need to help customers reach their financial goals in the ways that best suits them.

Subscribe to our free newsletter and get the Genesys blog updates in your inbox.