“Our advisors can easily switch from a phone call or web messaging and escalate to a video conversation in a single click,” added Kokhuis. “We arrange around 15,000 video calls with customers each month, often for emotional life events such as buying a new house or dealing with a bereavement.”

Better matching, best experience

Personalisation and reducing customer effort are also top priorities for Rabobank. To facilitate more seamless repeat interactions — such as those between a customer and a mortgage advisor — the bank’s CRM system identifies the caller and routes them directly to the same person whenever possible.

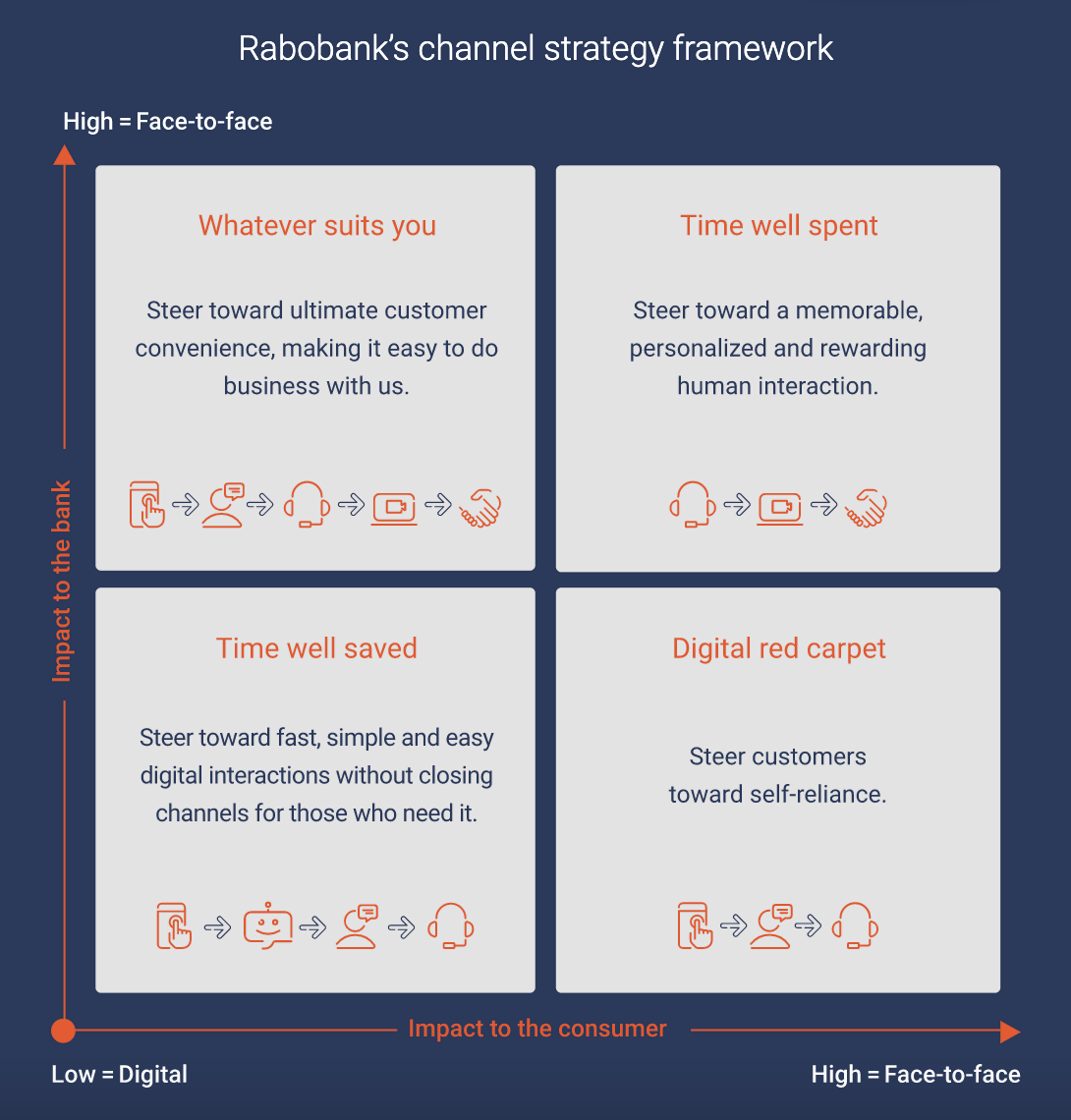

Smart intent-based routing rules play a crucial role here. It determines where the customer conversation will be picked up and steers the customer to the best channel and most suitable advisor. Those rules detect factors like customer sentiment (using voice recognition analysis); current products and value; and cross-sell and up-sell opportunities. They also match contacts with wait times, skills and resources available at exactly the right moments.

Meeting customers where they are

The bank’s new cloud contact centre platform improves resilience and agility — significantly reducing cost and risk for the business, clients and employees. And Rabobank can easily onboard new departments and launch extra channels, features and services — enabling it to speed innovation to customers faster than its competitors.

“Web messaging is 25% more efficient compared to call handling, meaning we can serve more customers without increasing headcount,” said Kokhuis. “And since introducing video calls we’ve seen a noticeable uplift in new mortgage sales.”

Shifting from voice to digital-first conversational banking delivers greater convenience and improved customer experience. Virtual assistants never sleep and answer around 45% of all questions 24/7. Web messaging volumes have risen from 15% to 20% of all interactions. These improvements have delivered customer satisfaction rates of 90% and above for these digital channels.

Less effort, better engagement, happier employees

Moving to a single omnichannel solution has positively impacted the bank’s top and bottom lines and performance KPIs. Decommissioning on-premises systems provided annual savings of $750,000 on hardware and $1,500,000 on IT staff costs. Business changes like new features or routing policies can be delivered in days — compared to four weeks before.

“With asynchronous web messaging, we no longer have lengthy, hard-to-manage live chat queues as agents and customers can interact when the other party is offline,” said Kokhuis. “We’re also able to hold the customer’s place in the queue, reducing effort for them and us. And conversations can be easily resumed so they don’t have to start from scratch.”