Your Genesys Blog Subscription has been confirmed!

Please add genesys@email.genesys.com to your safe sender list to ensure you receive the weekly blog notifications.

Subscribe to our free newsletter and get blog updates in your inbox

Don't Show This Again.

This blog post was co-authored by Genesys technology partner, Lightico.

Financial institutions make significant investments into attracting new customers. Yet, the first real test of your institution’s comes in onboarding.

Customers are accustomed to fast and painless interactions, even from their mobile phones. Too often, they are disappointed with their initial banking experiences. In fact, nearly half of consumers report having abandoned an onboarding process when applying for a bank account. Lengthy, paperwork-heavy processes often are the culprit, driving consumers to seek out digital-first alternative that give them the speed and ease they want.

Thanks to widespread adoption of instant, digital ecosystems like Amazon and Uber, today’s consumers expect immediate satisfaction. Customers demand convenient end-to-end purchasing or servicing in real time, accessible from anywhere, at any time. Without even realizing it, they’ve come to expect the same experience from banking services and products as well. So, when banks require new customers to download forms to print, sign, fax, speak with a service rep or come into a physical branch, it’s no wonder customers become impatient and look elsewhere for an easier banking service.

Not surprisingly, 40% of consumers abandon onboarding processes when opening a new bank account. Too lengthy of a process, time-consuming authentication and difficulty in filling out forms are among the top four reasons. Another survey of customers that abandoned a mobile banking activity detailed that 45% gave up on pursuing the activity entirely, 18% completed the activity using another channel, 7% opened an account at another bank, and 5% stopped or reduced activity with that bank.

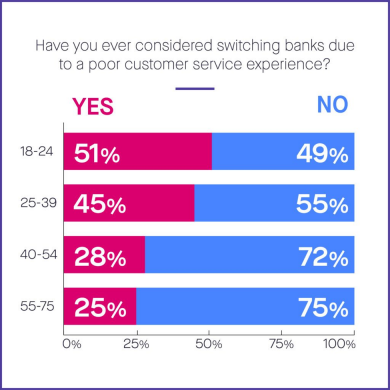

In fact, customer experience is so important for customers that they’re open to switch banks to get it.

Clearly, if banks can’t deliver a fast and seamless onboarding experience and, in particular a mobile one, customers will try another financial services provider. In fact, according to Forrester, more than 64% of banks reported lost revenue because of problems in their current onboarding processes.

One of the biggest challenges banks face in creating the onboarding experience that consumers expect is increasingly stringent and complex requirements to meet Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. Banks must complete intensive checks for money laundering and fraud before they agree to handle a customer’s money, otherwise they could face stiff penalties. Therefore, customer identity authentication and due diligence are becoming more intensive and time-consuming.

Given the gap between customer expectations and the current reality, you need to find ways to streamline your onboarding process to stay competitive. With the right technology and best practices, it’s easy to both satisfy the regulatory demands of the compliance officer and the convenience demands of the consumer — without compromising on either.

Here are implementation steps that will make the biggest difference:

Today’s consumer expects to access banking services quickly, anywhere, and at any time. That means any onboarding solution must include a mobile format for all steps in the process.

While existing bank customers may use a dedicated mobile application for day-to-day transactions, prospective customers are reluctant to download a specific application. They don’t have the time or patience to figure it out. Banks should look for immediate and complete ways to onboard customers — especially using mobile phones.

New technologies enable a customer to start and finish the entire onboarding through a simple text message to their mobile phone. Clicking on a link in the message opens a secure portal for interacting and completing all onboarding steps — with no need to break the customer journey for printing, signing, or uploading and emailing supporting documents and identification.

New regulatory requirements around AML and KYC are challenging for banks and their customers. Specifically, they require potential customers to submit documentation and identification to verify and authenticate their identity. In many instances, these are submitted in person or require customers to scan and email or login to confusing portals. Either method is cumbersome and time consuming — and leaves room for clerical mistakes.

With advanced ID verification and authentication solutions that include fully automated KYC, a customer can use a mobile phone to photograph and submit pictures of their face and driver’s license for approval. New solutions also enable customers to fulfill compliance requirements from a mobile phone. Customers can snap a picture of their identification and complete picture-based verification. Onboarding time is slashed, the risk of fraud is reduced, and the strictest of ID and verification requirements are completed instantly.

Long and complicated PDF forms are only a small step up from traditional paperwork. They must be downloaded, completed, and then scanned in or uploaded again, requiring numerous touchpoints. Mistakes and omissions create delays, especially when customers must fill in several detailed fields. Service reps on the other end find it difficult to read handwritten fields.

With smart eForms, customer completion rates are much higher. eForms that are mobile-optimized, simplified in their presentation, and leverage autofill and CRM-prefill, are easy to complete. And, if needed, service reps can offer assistance while viewing the same eForm at the same time with the customer.

Simplified and collaborative smart eForms ensure that formwork is completed in real time — without omissions that would otherwise cause delay. Then eForms can be submitted instantly from any device. Other benefits include presenting terms and conditions in an eForm format, instead of having a service rep read them from a script. Customers can read for themselves and approve faster. Essentially, eForms save time, improve completion rates and accelerate the customer journey.

Banks that require customers to download, print, sign, and scan or fax their consent forms are losing business. These tasks are time consuming, require a number of different devices and discourage completion of the onboarding process. Additionally, eSignatures that are sent to a customer’s cluttered email inbox often go unnoticed. And, if opened, they can appear daunting; most won’t be signed or they’re returned.

New solutions enable banks to obtain legally binding customer consent instantly, from anywhere. By clicking on a link in a simple text message received on a mobile phone, a customer can access and sign a secure document. Because the process is so easy and fast, banks can close more sales — slash costs and reduce cycle time and compliance exposure. With eSignatures, you accelerate the customer’s compliance and sales journey.

With so many different steps, forms, rules and nuances in the onboarding process, customers understandably become confused and frustrated. They’re either required to use more contact points with the bank to complete the process or they abandon and forfeit the service altogether. Either way, banks lose out to higher administrative costs and lost sales.

Yet, with real-time collaboration, service reps can help a potential new customer navigate the onboarding process. Customers can view the application on their cell phone while speaking to a rep who shares the same active screen view and provides guidance along the way.

Now, financial institutions can benefit from digital solutions that remove all friction from onboarding. Using Genesys and Lightico, it’s now possible to collect eSignatures, documents, verify ID and complete forms from new customers in real time — even from their mobile phones. This integration makes it easy for teams to streamline onboarding processes, eliminate costly abandonment and reduce compliance overhead.

Lightico integrates seamlessly, and is native to, Genesys — with no additional installation required. It allows banks to quickly and economically increase new customer acquisition, reduce onboarding abandonment and reduce the cost of compliance. Learn more about Genesys AppFoundry partner Lightico and its digital banking solution by scheduling your free trial today. Or visit their listing in the AppFoundry marketplace.

Subscribe to our free newsletter and get blog updates in your inbox.