A bank focused on progress

Banco Solidario was established in 2013 in a merger with Unibanco; both companies had spent nearly two decades providing credit to economically vulnerable people. Today, the bank focuses on providing services to microbusinesses, a vitally important segment for social progress that’s been neglected by traditional banking.

As the first bank in Latin America to specialize in microcredit with 100% private capital, Banco Solidario is exclusively dedicated to this form of financial operation. To date, it has supported the growth and development of 580,000 small entrepreneurs and disbursed more than $11 million in microloans.

Searching for an omnichannel platform

Banco Solidario is known for its innovative risk assessment and management practices. And its contact center is critical to support its massive credit placement model, which includes sales and collections channels.

Until 2019, the financial institution’s call center was based on an on-premises, internally developed solution. But it became increasingly difficult to keep up with complex and changing customer needs.

“When we saw the need to add more channels, we started the search for a versatile platform with the capacity to manage the omnichannel ecosystem,” said Damián Cruz, Digital Channel Consultant at Banco Solidario.

Achieving digital transformation in the cloud

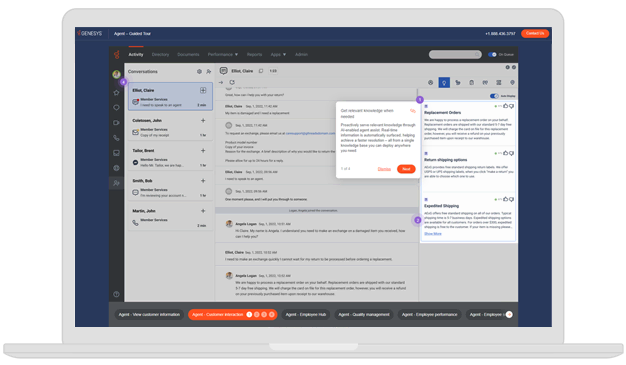

To better serve its customers, Banco Solidario needed a digital transformation. The IT team analyzed available solutions and, after a demanding selection process, chose the Genesys Cloud platform. This move made it the first bank in Ecuador to have a cloud contact center solution.

“I won’t lie. At first, we were a little afraid of how safe and efficient it could be to have resources in the cloud. But after a year, we are convinced that choosing Genesys Cloud was the right way to go,” said Cruz.

With the new solution, the bank could organize, monitor and manage the growing volume of interactions in mobile digital channels. And Banco Solidario was able to offer customers the same personalized treatment they receive in physical branches — a key to the bank’s success.

Today, Genesys Cloud orchestrates all the bank’s customer service channels: voice, email, chat and an artificial intelligence (AI)-powered bot.

“The truth is that we have taken a burden off our IT team and transferred it to Genesys and its partner Seteinfo,” added Cruz.