In its search to find a partner who could help them orchestrate the best customer experiences, BancoEstado chose the Genesys Cloud platform due to the support of Genesys Professional Services, which provided abundant technical documentation, and the platform’s native integration with existing third-party products.

A fast, incremental approach to the cloud

The BancoEstado cloud migration involved not only a change of technology, but also careful implementation of a new management model, in which the company’s IT team implements and manages technologies with the help of Genesys and other partners. The bank opted for a gradual change to minimize errors that can arise in a technology transformation.

“We didn’t want to make a big-bang kind of change, because that would inevitably lead to errors,” said Chávez Tuesta. “It had to be interactive and gradual. Considering the results, I think this approach, with the help of Genesys, was very successful.”

The phased transition began with attention to their phone line to address customer banking emergencies; everyone involved was highly motivated from the beginning. It was an intensive process in which BancoEstado used the technical documentation from Genesys to carefully understand the new customer service model that included everything from the simplest services to the most complex ones.

“The move was very fast,” said Molina Carvajal. “Initially, we thought the implementation was going to be very difficult, but with a synchronized team effort from the bank and Genesys, we did it in two and a half months, with more than 70% of our services live and running.”

Enabling customer visibility and remote working

Before the pandemic, contact center applications weren’t connected to other IT systems within the bank. Agents received calls and logged them in their own application, and other banking teams had no visibility into what was happening.

“When we integrated our Genesys solution with Salesforce, we got a 360-degree view of the customer,” said Molina Carvajal. “This was a huge gain. It let us apply the concept of ‘I know my customer,’ which is fundamental.”

At the same time, the IT team led by Chávez Tuesta integrated the Genesys solution with the bank’s legacy systems by developing a connector in Amazon Web Services (AWS).

Along with helping BancoEstado integrate various systems, the Genesys cloud solution allowed it to automate important processes. And having fully trained teams and leaders at the call center, the bank reduced its average monthly contacts by 10% — about 100,000 fewer calls — allowing it to better serve customers.

BancoEstado was also able to delocalize 300 of its 1,400 agents, allowing it to meet social distancing requirements in the contact center. Through a mix of remote and on-site work, it was able to retain its original pre-crisis staff, with no reductions.

Through hard work, the call center also improved agent shift adherence with Genesys Cloud Workforce Engagement Management. This capability simplified workforce planning and scheduling, providing BancoEstado data on what times were most productive, improving and optimizing its customer service time and attention.

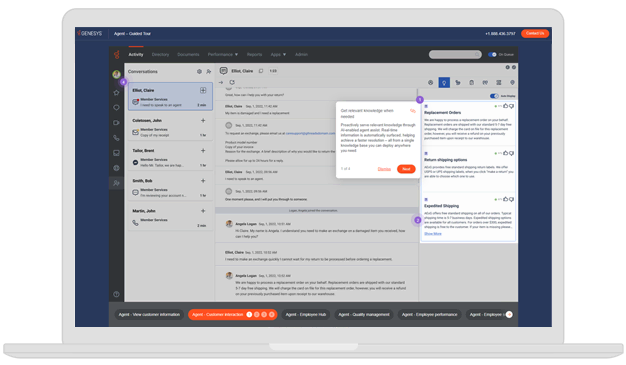

“Genesys Cloud allows us to do all of our management ourselves, because the systems our agents use have a simple and intuitive format,” said Luis Iturrieta Muñoz, Operations Manager of the 24-hour contact service at BancoEstado. “This lets us reduce management times and avoid having to resort to costly solutions. It also makes the agent training process very simple and user-friendly, allowing agents to learn to use the system in a matter of minutes.”

Improving contact center KPIs

After using Genesys Cloud for a few months, BancoEstado saw the success of its IT strategy in dramatic improvements of its main contact center KPIs.