Enabling an omnichannel customer experience

FE Credit previously relied on multiple systems operating in silos to serve its customers. Before the Genesys solution was integrated, FE Credit was using two contact centers for different purposes. One was for customer services inbound IVR, and the other for collection outbound auto-dialer campaigns. Deployment of Genesys has seamlessly integrated multiple FE Credit channels into a single unified system.

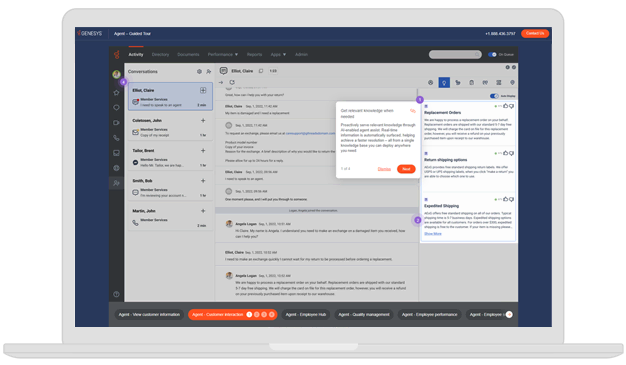

Genesys has enabled FE Credit to transform its communication channel strategy from disparate inbound IVR and outbound auto-dialer campaigns into a streamlined 360-degree omnichannel approach. It allows inbound and outbound calls, email, web and mobile, as well as social media channels using Facebook Messenger on an integrated single agent desktop application. The system also provides detailed reports on service rates, operation activities and agent productivity.

Banking on the voice of the customer

The FE Credit business model is moving towards greater diversification as it seeks to acquire new customers and increase market share. As business demands evolve in the intensely competitive market, the organization needs to ensure highly personalized customer experiences supported by an agile infrastructure that can meet the diverse needs of the business.

Genesys provides FE Credit with an on-premises solution powered by built-in artificial intelligence and machine learning engines. The solution is enabling FE Credit to obtain valuable insights about customer demand, based on which the system intelligently routes the customer to the agent with the right skill sets to handle specific situations. All touchpoints created along the journey become seamlessly integrated into their CRM system for further analysis.

In the future, FE Credit plans to maintain a consolidated unified communication stack by migrating to Genesys Cloud™.